Entrepreneurial fauna: anatomy of unicorns and other successful start-up species

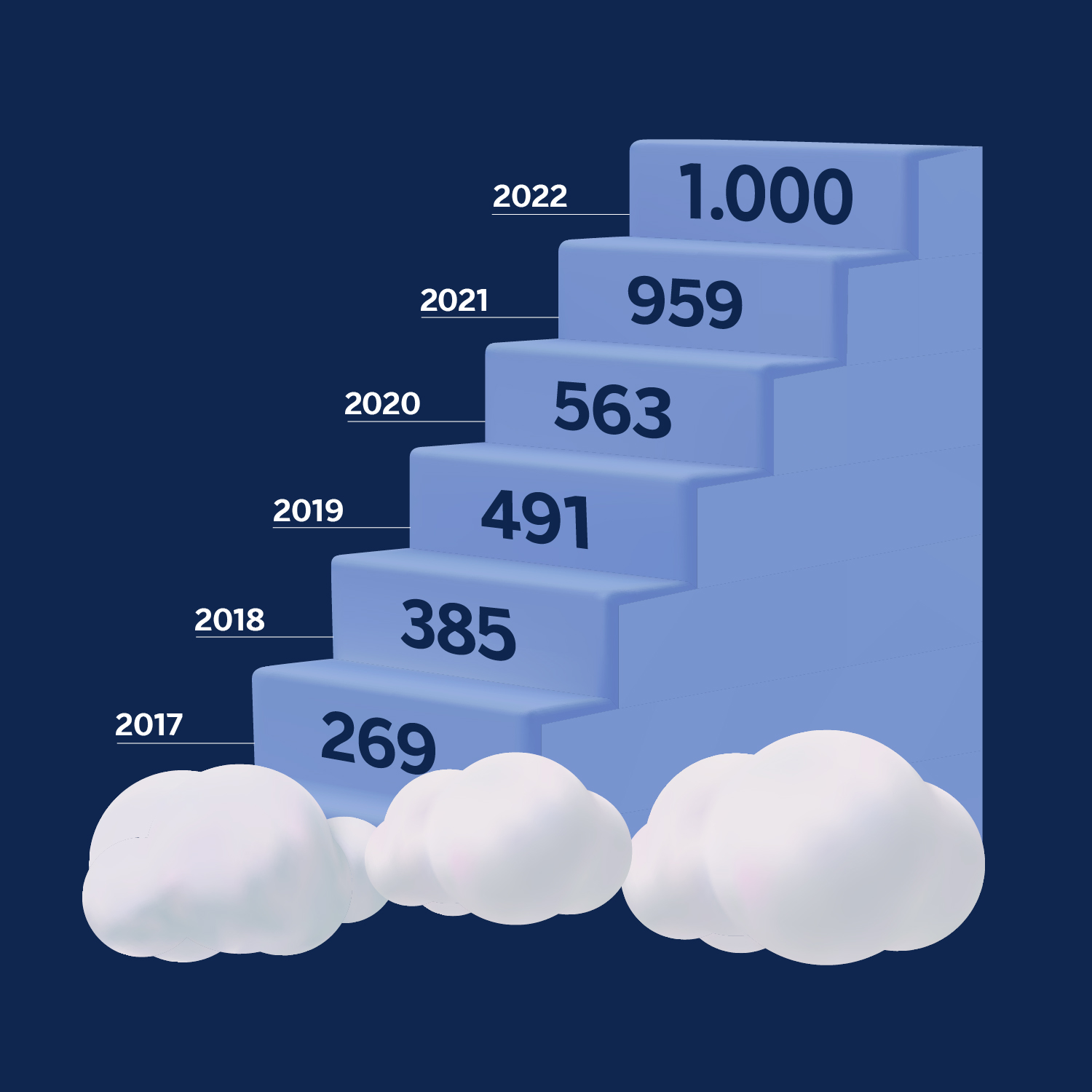

Technology start-ups dream of becoming unicorns: projects that reach a valuation of more than $1 billion (about 880 million euros) before going public. Characterised by their extreme uniqueness, they have grown from a few dozen to a thousand and have expanded from Silicon Valley to the world. But they are not the only animal that stands out in the start-up kingdom.

Portrait of a mythological animal

The origin of a species

Ailen Lee, investor and leader of venture capital firm Cowboy Ventures, used the term ‘unicorn’ making reference to the technology field in a 2013 ‘TechCrunch’ article.

The first list included 39 start-ups that grew over the years:

- Facebook (Meta), Twitter and Airbnb. They went public.

- LinkedIn, YouTube and Instagram. They were acquired by Microsoft, Google (Alphabet) and Facebook, respectively for multi-million dollar amounts.

How does a unicorn emerge?

An emerging company achieves this category after having closed an advanced financing round and reaching a valuation of 1 billion dollars. Investors and venture capital firms are in charge of valuing them based on their growth and development forecasts.

Magical attributes

- Scaled up in a short time. They have a global outlook and a fast-growth mentality.

- Disruption. Technology is their mainstay for innovation: with it they redefine how things are done in a sector or explore new business niches.

The growth of an extraordinary group

In 2021, the club grew by around 70% due to record venture capital investment figures and accelerated digitalisation brought about by the pandemic.

Unicorns around the world

They started in the U.S.A., but in recent years they have grown more in Europe and Latin America.

Europe

– Spain: 4. JobandTalent | Human Resources

– Turkey: 2. Getir | Delivery

Latin America

– Brazil: 15. QuintoAndar* | ‘E-commerce’

– Mexico: 6. Kavak* | ’E-commerce’

– Colombia: 2. Rappi* | Delivery

– Argentina: 1. Ualá* | ‘Fintech’

*Highest rated unicorn in the country

Fintech, a leading field

Top five unicorn sectors

- ‘Fintech‘: 20%

- Internet services and software: 18%

- E-commerce and consumer services: 11%

- Artificial intelligence: 8%

- Cybersecurity: 4%

In addition to these areas, there are small groups dedicated to data analytics, telecommunications, transportation, ‘edtech’, retail, logistics and ‘traveltech’.

Those who are at the top of the league…

The ones that fly the highest are the decacorns (valued at more than $10 billion). There are almost 50 worldwide.

Top five decacorns

- Bytedance. China. Valuation: $140 billion. Artificial intelligence-based content giant and parent company of the TikTok video app.

- SpaceX. U.S.A. Valuation: $100 billion. The aerospace company founded by Elon Musk has launched more than 100 rockets.

- Stripe. Ireland/ U.S.A. Valuation: $95 billion. Online payment platform that allows companies to manage their business.

- Klarna. Sweden. Valuation: $45 billion. Payment and purchase instalment service provider that works with thousands of merchants.

- Epic Games. U.S.A. Valuation: $42 billion. Creator of Unreal Engine, the graphics engine behind famous video games.

… and those who fall at the first hurdle

Not all unicorns are still galloping. The most resounding failure was that of Theranos, which promised to revolutionise blood testing and was valued at $9 billion. A Wall Street Journal investigation revealed the fraud.

Shadows in a multicoloured world

- Fever? Some analysts are wary of the rise of unicorns and compare it to the dotcom bubble of the 2000s.

- Overvaluation? Their value is not based on financial results, but on predictions, so they tend to prioritise growth over profitability.

The technological zoo

Becoming a unicorn is not the only way to measure a company’s success; there are other species.

- Gazelles. Companies, technology or otherwise, that increase their revenues by more than 20% per year for four years or more, with a base of $100,000.

- Zebras. Start-ups that focus on having a positive social impact. A group of women entrepreneurs created the movement Zebras Unite to demand investment in minority-founded start-ups.

- Camels. Companies that make efficient use of small amounts of capital rather than closing large rounds and are prepared to deal with setbacks such as the pandemic.

- Cockroaches. Resilience is their strength, and they survive without making the headlines. They are generally smaller than camels.

- Phoenix. These companies are capable of growing, falling and rising from the ashes. They tend to lie outside of traditional entrepreneurial ecosystems.

Towards a future of green meadows: Where is sustainability?

Larry Fink, CEO of BlackRock investment management company

The unicorn club continues to grow and will continue to mark entrepreneurial success, but start-ups are no longer just looking for accelerated growth. Sustainability will be essential for the survival of the ecosystem.